HW1

function X=BSCall(S,K,r,sigma,T)

Q=(log(S/K)+(r+sigma^2/2)*T)/(sigma*sqrt(T));

W=Q-(sigma*sqrt(T));

X=S*normcdf(Q)-K*(exp(-r*T)*normcdf(W));

function X=BSPut(S,K,r,sigma,T)

Q=(log(S/K)+(r+sigma^2/2)*T)/(sigma*sqrt(T));

W=Q-(sigma*sqrt(T));

X=-S*normcdf(-Q)+K*(exp(-r*T)*normcdf(-W));

function B = PV(y,n,C)

for i=1:n

D(i)= 1/((1+y)^(i-1));

end

D*C

HW2

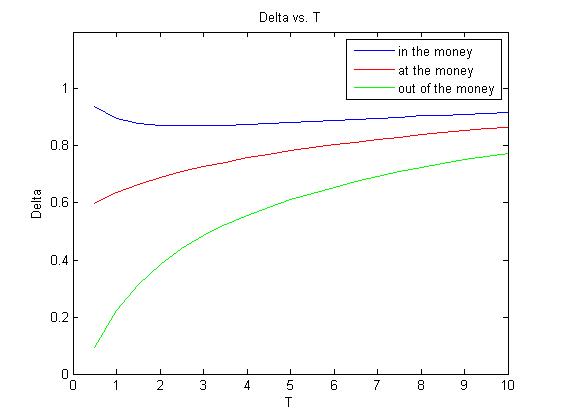

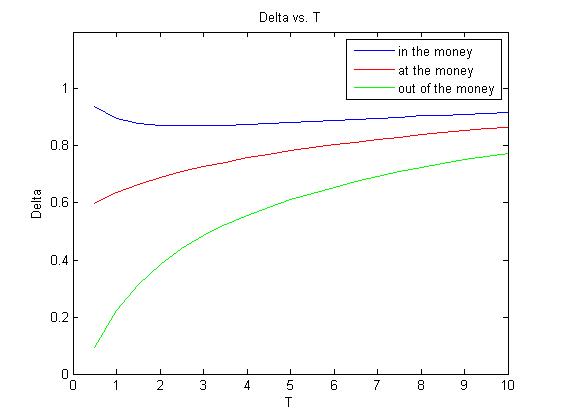

Delta

x=50;

r=0.05;

t=0.5:0.5:10;

sig=0.2;

div=0;

s=60;

call_delta1= blsdelta(s,x,r,t,sig,div);

call_delta2= blsdelta(s-10,x,r,t,sig,div);

call_delta3= blsdelta(s-20,x,r,t,sig,div);

plot(t,call_delta1,'-')

hold on;

plot(t,call_delta2,'-r')

plot(t,call_delta3,'-g')

title('Delta vs. T')

xlabel('T')

ylabel('Delta')

legend('in the money','at the money','out of the money')

axis([0 10 0 1.2]);

Gamma

x=50;

r=0.05;

t=0.5:0.5:10;

sig=0.2;

div=0;

s=60;

call_delta1= blsdelta(s,x,r,t,sig,div);

call_delta2= blsdelta(s-10,x,r,t,sig,div);

call_delta3= blsdelta(s-20,x,r,t,sig,div);

plot(t,call_delta1,'-')

hold on;

plot(t,call_delta2,'-r')

plot(t,call_delta3,'-g')

title('Delta vs. T')

xlabel('T')

ylabel('Delta')

legend('in the money','at the money','out of the money')

axis([0 10 0 1.2]);

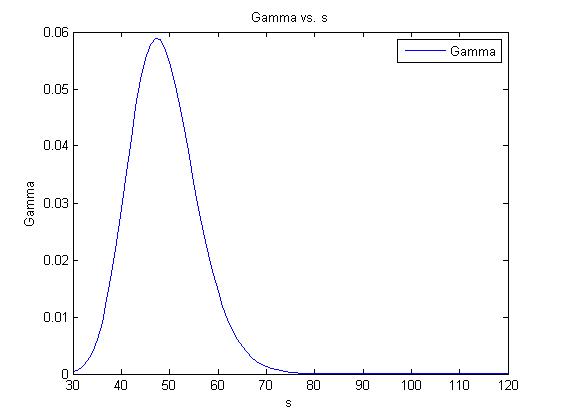

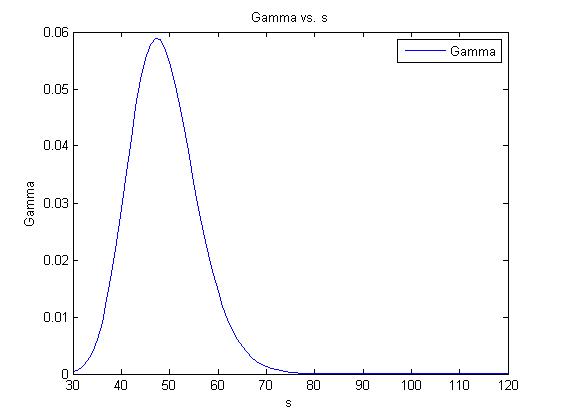

Gamma

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_gamma = blsgamma(s,x,r,t,sig,div);

plot(s,call_gamma,'-')

title('Gamma vs. s')

xlabel('s')

ylabel('Gamma')

legend('Gamma')

Theta

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_gamma = blsgamma(s,x,r,t,sig,div);

plot(s,call_gamma,'-')

title('Gamma vs. s')

xlabel('s')

ylabel('Gamma')

legend('Gamma')

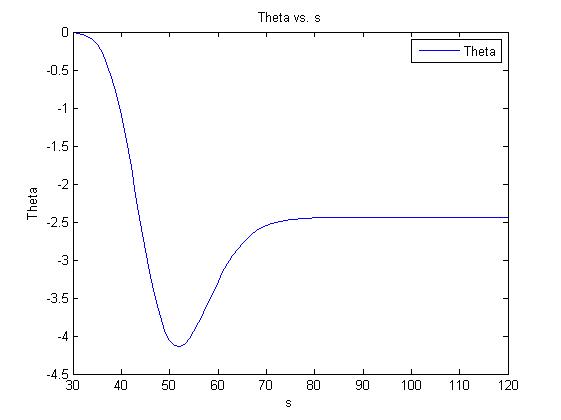

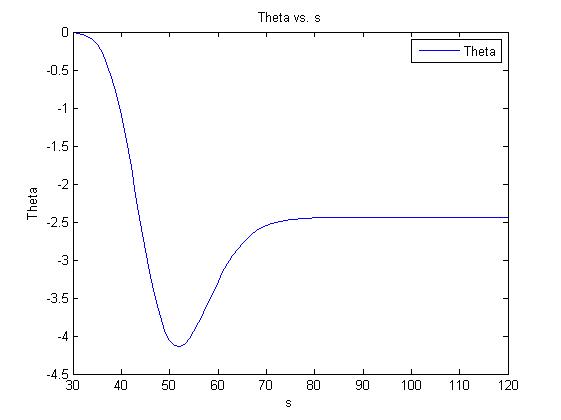

Theta

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

[call_theta,put_theta]=blstheta(s,x,r,t,sig,div);

plot(s,call_theta,'-')

title('Theta vs. s')

xlabel('s')

ylabel('Theta')

legend('Theta')

Vega

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

[call_theta,put_theta]=blstheta(s,x,r,t,sig,div);

plot(s,call_theta,'-')

title('Theta vs. s')

xlabel('s')

ylabel('Theta')

legend('Theta')

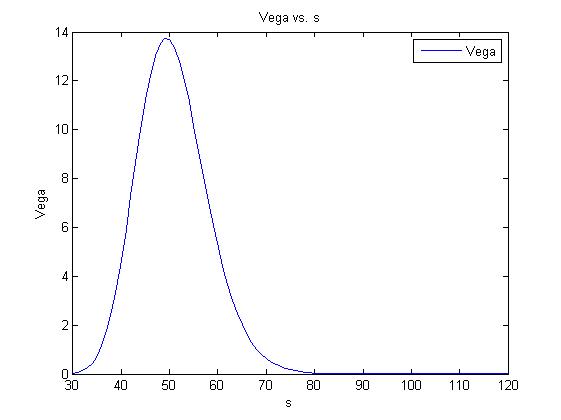

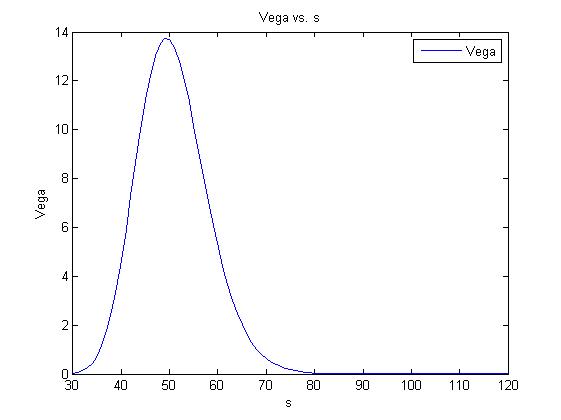

Vega

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_vega = blsvega(s,x,r,t,sig,div);

plot(s,call_vega,'-')

title('Vega vs. s')

xlabel('s')

ylabel('Vega')

legend('Vega')

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_vega = blsvega(s,x,r,t,sig,div);

plot(s,call_vega,'-')

title('Vega vs. s')

xlabel('s')

ylabel('Vega')

legend('Vega')

HW4

%Callprice.m

function [C,P] = blsprice(S0,X,r,T,sigma)

X=20:1:80;

S0=50;

r=0.08;

sigma=0.4;

T=1;

[C,P] = blsprice(S0,X,r,T,sigma);

plot(X,C,'-r');

hold on;

T=0;

[C,P] = blsprice(S0,X,r,T,sigma);

plot(X,C,'-blue');

hold on;

axis([20 80 0 25]);

title('Call price v.s. Exercise Price');

xlabel('Exercise price');

ylabel('Call price');

legend('EurCall value','內含價值(T=0)');

function [C,P] = blsprice(S0,X,r,T,sigma)

X=20:1:80;

S0=50;

r=0.08;

sigma=0.4;

T=1;

[C,P] = blsprice(S0,X,r,T,sigma);

plot(X,P,'-r');

hold on;

T=0;

[C,P] = blsprice(S0,X,r,T,sigma);

plot(X,P,'-blue');

hold on;

axis([20 80 0 25]);

title('Put price v.s. Exercise Price');

xlabel('Exercise price');

ylabel('Put price');

legend('EurPut value','內含價值(T=0)');

HW5

function [price, lattice] = LatticeAmCallDivD(S0,X,r,T,sigma,N,D,tau)

deltaT = T/N;

u=exp(sigma * sqrt(deltaT));

d=1/u;

p=(exp(r*deltaT) - d)/(u-d);

S0a=S0-D*exp(-r*tau*deltaT);

lattice = zeros(N+1,N+1);

for j=0:N

lattice(N+1,j+1)=max(0 , -X+S0a*(u^j)*(d^(N-j)));

end

for i=N-1:-1:tau

for j=0:i

lattice(i+1,j+1) = max( -X+S0a*u^j*d^(i-j) , ...

exp(-r*deltaT) *(p * lattice(i+2,j+2) + (1-p) * lattice(i+2,j+1)));

end

end

for i=tau-1:-1:0

for j=0:i lattice(i+1,j+1) = max( -X+S0a*u^j*d^(i-j)+D*exp(-r*(tau-i)*deltaT) , ...

exp(-r*deltaT) *(p * lattice(i+2,j+2) + (1-p) * lattice(i+2,j+1)));

end

end

price = lattice(1,1);

function [price, lattice] = LatticeAmCallDivP(S0,X,r,T,sigma,N,div,tau)

deltaT = T/N;

u=exp(sigma * sqrt(deltaT));

d=1/u;

p=(exp(r*deltaT) - d)/(u-d);

lattice = zeros(N+1,N+1);

for j=0:N

lattice(N+1,j+1)=max(0 , S0*(u^j)*(d^(N-j))*(1-div)-X);

end

for i=N-1:-1:tau

for j=0:i

lattice(i+1,j+1) = max(-X+S0*u^j*d^(i-j)*(1-div) , ...

exp(-r*deltaT) *(p * lattice(i+2,j+2) + (1-p) * lattice(i+2,j+1)));

end

end

for i=tau-1:-1:0

for j=0:i

lattice(i+1,j+1) = max(-X+S0*u^j*d^(i-j) , ...

exp(-r*deltaT) *(p * lattice(i+2,j+2) + (1-p) * lattice(i+2,j+1)));

end

end

price = lattice(1,1);

function [price, lattice] = LatticeEurCallDivD(S0,X,r,T,sigma,N,D,tau)

deltaT = T/N;

u=exp(sigma * sqrt(deltaT));

d=1/u;

p=(exp(r*deltaT) - d)/(u-d);

S0a=S0-D*exp(-r*tau*deltaT);

lattice = zeros(N+1,N+1);

for j=0:N

lattice(N+1,j+1)=max(0 , -X+S0a*(u^j)*(d^(N-j)));

end

for i=N-1:-1:0

for j=0:i

lattice(i+1,j+1) = exp(-r*deltaT)*...

(p*lattice(i+2,j+2)+(1-p)*lattice(i+2,j+1));

end

end

price = lattice(1,1);

function [price, lattice] = LatticeEurCallDivP(S0,X,r,T,sigma,N,div,tau)

deltaT = T/N;

u=exp(sigma * sqrt(deltaT));

d=1/u;

p=(exp(r*deltaT) - d)/(u-d);

lattice = zeros(N+1,N+1);

for j=0:N

lattice(N+1,j+1)=max(0,-X+S0*(u^j)*(d^(N-j))*(1-div));

end

for i=N-1:-1:tau

for j=0:i

lattice(i+1,j+1) = exp(-r*deltaT)*(1-div)*...

(p*lattice(i+2,j+2)+(1-p)*lattice(i+2,j+1));

end

end

for i=tau-1:-1:0

for j=0:i

lattice(i+1,j+1) = exp(-r*deltaT)*...

(p*lattice(i+2,j+2)+(1-p)*lattice(i+2,j+1));

end

end

price = lattice(1,1);

function [price, lattice] = LatticeEurPutDivD(S0,X,r,T,sigma,N,D,tau)

deltaT = T/N;

u=exp(sigma * sqrt(deltaT));

d=1/u;

p=(exp(r*deltaT) - d)/(u-d);

S0a=S0-D*exp(-r*tau*deltaT);

lattice = zeros(N+1,N+1);

for j=0:N

lattice(N+1,j+1)=max(0 , X-S0a*(u^j)*(d^(N-j)));

end

for i=N-1:-1:0

for j=0:i

lattice(i+1,j+1) = exp(-r*deltaT)*...

(p*lattice(i+2,j+2)+(1-p)*lattice(i+2,j+1));

end

end

price = lattice(1,1);

function [price, lattice] = LatticeEurPutDivP(S0,X,r,T,sigma,N,div,tau)

deltaT = T/N;

u=exp(sigma * sqrt(deltaT));

d=1/u;

p=(exp(r*deltaT) - d)/(u-d);

lattice = zeros(N+1,N+1);

for j=0:N

lattice(N+1,j+1)=max(0,X-S0*(u^j)*(d^(N-j))*(1-div));

end

for i=N-1:-1:tau

for j=0:i

lattice(i+1,j+1) = exp(-r*deltaT)*(1-div)*...

(p*lattice(i+2,j+2)+(1-p)*lattice(i+2,j+1));

end

end

for i=tau-1:-1:0

for j=0:i

lattice(i+1,j+1) = exp(-r*deltaT)*...

(p*lattice(i+2,j+2)+(1-p)*lattice(i+2,j+1));

end

end

price = lattice(1,1);

function [price, lattice] = TriAmPut(S0,X,r,T,sigma,N,lamda)

deltaT = T/N;

u=exp(lamda*sigma * sqrt(deltaT));

d=1/u;

pu=1/(2*lamda^2)+(r-(sigma^2/2))*sqrt(deltaT)/(2*lamda*sigma);

pm=1-1/(lamda^2);

pd=1-pu-pm;

lattice = zeros(N+1,2*N+1);

for j=1:N+1

lattice(N+1,j)=max(0 , -S0*(d^(N-j+1)) + X);

end

for j=N+2:2*N+1

lattice(N+1,j)=max(0 , -S0*(u^(j-N-1)) + X);

end

for i=N-1:-1:0

for j=1:2*i+1

lattice(i+1,j+1) = max( X-S0*u^j*d^(i-j) , ...

(pd * lattice(i+2,j) + pm * lattice(i+2,j+1)+ ...

pu*lattice(i+2,j+2)));

end

end

function [price, lattice] = TriEurPut(S0,X,r,T,sigma,N,lamda)

deltaT = T/N;

u=exp(lamda*sigma * sqrt(deltaT));

d=1/u;

pu=1/(2*lamda^2)+(r-(sigma^2/2))*sqrt(deltaT)/(2*lamda*sigma);

pm=1-1/(lamda^2);

pd=1-pu-pm;

lattice = zeros(N+1,2*N+1);

for j=1:N+1

lattice(N+1,j)=max(0 , -S0*(d^(N-j+1)) + X);

end

for j=N+2:2*N+1

lattice(N+1,j)=max(0 , -S0*(u^(j-N-1)) + X);

end

for i=N-1:-1:0

for j=1:2*i+1

lattice(i+1,j) = exp(-r*deltaT) * ...

(pd * lattice(i+2,j) + pm * lattice(i+2,j+1)+ ...

pu*lattice(i+2,j+2));

end

end

HW6

% BlsMCAVD.m

function [Price, CI] = BlsMCAVD(S0,X,r,T,sigma,NRepl,q)

nuT = ((r-q)-0.5*sigma^2)*T;

siT = sigma*sqrt(T);

Veps = randn(NRepl,1);

Payoff1 = max( 0 , S0*exp(nuT+siT*Veps)-X);

Payoff2 = max( 0 , S0*exp(nuT+siT*(-Veps))-X);

DiscPayoff = exp(-r*T)*0.5*(Payoff1+Payoff2);

[Price, VarPrice, CI] = normfit(DiscPayoff);

% BlsMCAVDP.m

function [Price, CI] = BlsMCAVDP(S0,X,r,T,sigma,NRepl,q)

nuT = ((r-q)-0.5*sigma^2)*T;

siT = sigma*sqrt(T);

Veps = randn(NRepl,1);

Payoff1 = max( 0 ,X-S0*exp(nuT+siT*Veps));

Payoff2 = max( 0 ,X-S0*exp(nuT+siT*(-Veps)));

DiscPayoff = exp(-r*T)*0.5*(Payoff1+Payoff2);

[Price, VarPrice, CI] = normfit(DiscPayoff);

% BlsMCAVP.m

function [Price, CI] = BlsMCAVP(S0,X,r,T,sigma,NRepl)

nuT = (r - 0.5*sigma^2)*T;

siT = sigma * sqrt(T);

Veps = randn(NRepl,1);

Payoff1 = max( 0 , X-S0*exp(nuT+siT*Veps));

Payoff2 = max( 0 , X-S0*exp(nuT+siT*(-Veps)));

DiscPayoff = exp(-r*T) * 0.5 * (Payoff1+Payoff2);

[Price, VarPrice, CI] = normfit(DiscPayoff);

% BlsMCD.m

function [Price, CI] = BlsMCD(S0,X,r,T,sigma,NRepl,q)

nuT = ((r-q)-0.5*sigma^2)*T;

siT = sigma * sqrt(T);

DiscPayoff = exp(-r*T) * max( 0 , S0*exp(nuT+siT*randn(NRepl,1)) - X);

[Price, VarPrice, CI] = normfit(DiscPayoff);

% BlsMCDP.m

function [Price, CI] = BlsMCDP(S0,X,r,T,sigma,NRepl,q)

nuT = ((r-q)-0.5*sigma^2)*T;

siT = sigma * sqrt(T);

DiscPayoff = exp(-r*T) * max( 0 ,X-S0*exp(nuT+siT*randn(NRepl,1)));

[Price, VarPrice, CI] = normfit(DiscPayoff);

% BlsMCP.m

function [Price, CI] = BlsMCP(S0,X,r,T,sigma,NRepl)

nuT = (r - 0.5*sigma^2)*T;

siT = sigma * sqrt(T);

DiscPayoff = exp(-r*T) * max( 0 ,X-S0*exp(nuT+siT*randn(NRepl,1)));

[Price, VarPrice, CI] = normfit(DiscPayoff);

% CompBlsMCAVD.m Compare blsprice and BlsMCD200000 and BlsMCAVD100000

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

q=0.05;

NRepl1=100000;

NRepl2=200000;

Bls=blsprice(S0,X,r,T,sigma,q);

randn('seed',0);

[MC200000, CI1] = BlsMCD(S0,X,r,T,sigma,NRepl2,q);

randn('seed',0);

[MCAV100000, CI2] = BlsMCAVD(S0,X,r,T,sigma,NRepl1,q);

Bls

MC200000

CI1

MCAV100000

CI2

% CompBlsMCAVD.m Compare blsprice and BlsMCD200000 and BlsMCAVD100000

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

q=0.05;

NRepl1=100000;

NRepl2=200000;

[BlsC, BlsP]=blsprice(S0,X,r,T,sigma,q);

randn('seed',0);

[MC200000, CI1] = BlsMCDP(S0,X,r,T,sigma,NRepl2,q);

randn('seed',0);

[MCAV100000, CI2] = BlsMCAVDP(S0,X,r,T,sigma,NRepl1,q);

BlsP

MC200000

CI1

MCAV100000

CI2

% ComBlsMCAVP.m Compare blsprice and BlsMc200000 and BlsMCAV100000

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

NRepl1=100000;

NRepl2=200000;

[BlsC, BlsP]=blsprice(S0,X,r,T,sigma);

randn('seed',0);

[MCP200000, CI1] = BlsMCP(S0,X,r,T,sigma,NRepl2);

randn('seed',0);

[MCAVP100000, CI2] = BlsMCAVP(S0,X,r,T,sigma,NRepl1);

BlsP

MCP200000

CI1

MCAVP100000

CI2

% ComBlsMCP.m Compare blsprice and BlsMCP1000 and BlsMCP200000

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

NRepl1=1000;

NRepl2=200000;

[BlsC, BlsP]=blsprice(S0,X,r,T,sigma);

randn('seed',0);

[MCP1000, CI1000] = BlsMCP(S0,X,r,T,sigma,NRepl1);

randn('seed',0);

[MCP200000, CI200000] = BlsMCP(S0,X,r,T,sigma,NRepl2);

BlsP

MCP1000

CI1000

MCP200000

CI200000

HW8

%BlsHaltonEurCall.m

function Price = BlsHaltonEurCall(S0,X,r,T,sigma,NPoints,Base1,Base2)

nuT = (r-0.5*sigma^2)*T;

siT = sigma*sqrt(T);

rand('seed',0);

H1 = GetHalton(ceil(NPoints/2),Base1);

H2 = GetHalton(ceil(NPoints/2),Base2);

VLog = sqrt(-2*log(H1));

Norm1 = VLog.*cos(2*pi*H2);

Norm2 = VLog.*sin(2*pi*H2);

Norm = [Norm1;Norm2];

DiscPayoff = exp(-r*T) * max( 0 , S0*exp(nuT+siT*Norm) -X );

Price = mean(DiscPayoff);

%{

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

NPoints=5000;

%}

%BlsHaltonEurPut.m

function Price = BlsHaltonEurPut(S0,X,r,T,sigma,NPoints,Base1,Base2)

nuT = (r-0.5*sigma^2)*T;

siT = sigma*sqrt(T);

rand('seed',0);

H1 = GetHalton(ceil(NPoints/2),Base1);

H2 = GetHalton(ceil(NPoints/2),Base2);

VLog = sqrt(-2*log(H1));

Norm1 = VLog.*cos(2*pi*H2);

Norm2 = VLog.*sin(2*pi*H2);

Norm = [Norm1;Norm2];

DiscPayoff = exp(-r*T) * max( 0 , X-S0*exp(nuT+siT*Norm));

Price = mean(DiscPayoff);

%{

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

NPoints=5000;

%}

function Price = BlsRandBox(S0,X,r,T,sigma,NPoints)

nuT = (r - 0.5*sigma^2)*T;

siT = sigma * sqrt(T);

% Use Box to generate standard normals

rand('seed',0);

H1 = rand(NPoints,1);

H2 = rand(NPoints,1);

VLog = sqrt(-2*log(H1));

Norm1 = VLog.*cos(2*pi*H2);

Norm2 = VLog.*sin(2*pi*H2);

Norm = [Norm1;Norm2];

DiscPayoff = exp(-r*T) * max( 0 , X - S0*exp(nuT+siT*Norm) );

Price = mean(DiscPayoff);

end

%{

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

NPoints=5000;

%}

function Price = BlsRandBoxCall(S0,X,r,T,sigma,NPoints)

nuT = (r - 0.5*sigma^2)*T;

siT = sigma * sqrt(T);

% Use Box to generate standard normals

rand('seed',0);

H1 = rand(NPoints,1);

H2 = rand(NPoints,1);

VLog = sqrt(-2*log(H1));

Norm1 = VLog.*cos(2*pi*H2);

Norm2 = VLog.*sin(2*pi*H2);

Norm = [Norm1;Norm2];

DiscPayoff = exp(-r*T) * max( 0 , S0*exp(nuT+siT*Norm) -X );

Price = mean(DiscPayoff);

end

%{

S0=50;

X=52;

r=0.1;

T=5/12;

sigma=0.4;

NPoints=5000;

%}

function Seq = GetHalton(HowMany, Base)

Seq = zeros(HowMany,1);

NumBits = 1+ceil(log(HowMany)/log(Base));

VetBase = Base.^(-(1:NumBits));

WorkVet = zeros(1,NumBits);

for i=1:HowMany

% increment last bit and carry over if necessary

j=1;

ok = 0;

while ok == 0

WorkVet(j) = WorkVet(j)+1;

if WorkVet(j) < Base

ok = 1;

else

WorkVet(j) = 0;

j = j+1;

end

end

Seq(i) = dot(WorkVet,VetBase);

end

function h=HaltonSeq(m,b)

seq=zeros(m,1);

for n=1:m

n0 = n;

h(n) = 0;

f = 1/b;

while (n0 > 0)

n1 = floor(n0/b);

r = n0 - n1*b;

h(n) = h(n)+f*r;

f = f/b;

n0=n1;

end

end

% CompRandHalton

% Rand

for i=1:1000

U1 = rand()

U2 = rand()

VLog = sqrt(-2*log(U1));

X = VLog * cos(2*pi*U2);

Y = VLog * sin(2*pi*U2);

plot(X,Y,'o');

hold on

end

title('rand Box-Muller distribution');

grid on

HW9

function C=compound(s0,K1,K2,r,T1,T2,sigma,q)

sstar=fzero(@(x) blsprice(x,K2,r,T2-T1,sigma,q)-K1,99);

a1=(log(s0/sstar)+(r-q+(sigma^2)/2)*T1)/(sigma*sqrt(T1));

a2=a1-sigma*sqrt(T1);

b1=(log(s0/K2)+(r-q+(sigma^2)/2)*T2)/(sigma*sqrt(T2));

b2=b1-sigma*sqrt(T2);

C=s0*exp(-q*T2)*binorm(a1,b1,T1,T2)-K2*exp(-r*T2)*binorm(a2,b2,T1,T2)-K1*exp(-r*T1)*normcdf(a2);

end

function Q=binorm(a,b,T1,T2)

fun=@(x,y) (1/(2*pi*sqrt(1-T1/T2)))*exp(-(1/(1-T1/T2))*(x.^2-2*sqrt(T1/T2)*x*y+y.^2)/2);

Q=dblquad(fun,-10,a,-10,b);

end

function z=integrnd(x,y)

T1=0.25;

T2=1;

z=(1/(2*pi*sqrt(1-T1/T2)))*exp(-(1/(1-T1/T2))*(x.^2-2*sqrt(T1/T2)*x*y+y.^2)/2);

end

s0=100;

K1=8;

K2=100;

r=0.1;

T1=1;

T2=1.1;

sigma=0.2;

q=0.05;

Cp=[];

Ce1=[];

for T1=1:0.005:(T2)

C=compound(s0,K1,K2,r,T1,T2,sigma,q);

Cp=[Cp;C];

Ce=blsprice(s0,K1+K2,r,T2,sigma,q);

Ce1=[Ce1;Ce];

end

Cp=[Cp;C]

Ce1=[Ce1;Ce]

plot(Cp)

hold on;

plot(Ce1,'r')

xlabel('T1');

ylabel('price');

axis([1 8 1 15]);

HW10

function Price=BlsMCO(v0,u0,r,qv,qu,T,sigmav,sigmau,N,rho)

nuvT=(r-qv-0.5*sigmav^2)*T;

nuuT=(r-qu-0.5*sigmau^2)*T;

sivT=sigmav*sqrt(T);

siuT=sigmau*sqrt(T);

[x1,x2]=cholesky(rho,N);

DiscPayoff=exp(-r*T)*max(0,v0*exp(nuvT+sivT*x1)-u0*exp(nuuT+siuT*x2));

Price=normfit(DiscPayoff);

function [x1,x2]=cholesky(rho,N)

randn('seed',0);

x1=randn(N,1);

x2=rho*x1+sqrt(1-rho^2)*randn(N,1);

end

function C=outperform(v0,u0,qv,qu,sigmav,sigmau,T,rho)

sigma=sqrt(sigmav^2+sigmau^2-2*rho*sigmav*sigmau);

d1=(log(v0/u0)+(qu-qv+(sigma^2)/2)*T)/(sigma*sqrt(T));

d2=d1-sigma*sqrt(T);

C=v0*exp(-qv*T)*normcdf(d1)-u0*exp(-qu*T)*normcdf(d2);

end

v0=30;

u0=50;

qv=0.2;

qu=0.3;

sigmav=0.25;

sigmau=0.2;

T=1;

rho=0.2;

r=0.1;

BlsO=outperform(v0,u0,qv,qu,sigmav,sigmau,T,rho)

MCO100=BlsMCO(v0,u0,r,qv,qu,T,sigmav,sigmau,100,rho)

MCO1000=BlsMCO(v0,u0,r,qv,qu,T,sigmav,sigmau,1000,rho)

MCO10000=BlsMCO(v0,u0,r,qv,qu,T,sigmav,sigmau,10000,rho)

MCO100000=BlsMCO(v0,u0,r,qv,qu,T,sigmav,sigmau,100000,rho)

HW12

% AssetPaths1.m

function SPaths=AssetPaths1(S0,mu,sigma,T,NSteps,NRepl)

dt = T/NSteps;

nudt = (mu-0.5*sigma^2)*dt;

sidt = sigma*sqrt(dt);

Increments = nudt + sidt*randn(NRepl, NSteps);

LogPaths = cumsum([log(S0)*ones(NRepl,1) , Increments] , 2);

SPaths = exp(LogPaths);

%computeLookbackMCHalton

S0=50;

X=50;

r=0.1;

T=1;

sigma=0.4;

NSteps=300;

NRepl=1000;

PMC=LookbackMC(S0,r,T,sigma,NRepl,NSteps);

PHalton = LookbackHalton(S0,r,T,sigma,NRepl,NSteps);

PMC

PHalton

% HaltonPaths.m

function SPaths=HaltonPaths(S0,mu,sigma,T,NSteps,NRepl)

dt = T/NSteps;

nudt = (mu-0.5*sigma^2)*dt;

sidt = sigma*sqrt(dt);

NRepl = 2*ceil(NRepl/2); % make sure it's even

% Use Box Muller to generate standard normals

RandMat = zeros(NRepl, NSteps);

seeds = myprimes(2*NSteps);

Base1 = seeds(1:NSteps);

Base2 = seeds((NSteps+1):(2*NSteps));

for i=1:NSteps

H1 = GetHalton(NRepl/2,Base1(i));

H2 = GetHalton(NRepl/2,Base2(i));

VLog = sqrt(-2*log(H1));

Norm1 = VLog .* cos(2*pi*H2);

Norm2 = VLog .* sin(2*pi*H2);

RandMat(:,i) = [Norm1 ; Norm2];

end

Increments = nudt + sidt*RandMat;

LogPaths = cumsum([log(S0)*ones(NRepl,1) , Increments] , 2);

SPaths = exp(LogPaths);

%LookbackOptionHalton

function P = LookbackHalton(S0,r,T,sigma,NRepl,NSteps)

Payoff = zeros(NRepl,1);

Path = HaltonPaths(S0,r,sigma,T,NSteps,NRepl);

SMax=max(Path,[],2);

Payoff = max (0, SMax-Path(NSteps+1));

[P,aux,CI] = normfit(exp(-r*T)*Payoff);

%LookbackOptionMC

function [P,CI] = LookbackMC(S0,r,T,sigma,NRepl,NSteps)

Payoff = zeros(NRepl,1);

for i=1:NRepl

Path = AssetPaths1(S0,r,sigma,T,NSteps,1);

SMax = max(Path);

Payoff(i) = max (0, SMax-Path(NSteps+1));

end

[P,aux,CI]=normfit(exp(-r*T)*Payoff);

function p = myprimes(N)

found = 0;

trynumber = 2;

p = [];

while (found < N)

if isprime(trynumber)

p = [p , trynumber];

found = found + 1;

end

trynumber = trynumber + 1;

end

HW13

% EuPutExpl1.m

function price = EuPutExpl1(S0,X,r,T,sigma,Smax,dS,dt)

% set up grid and adjust increments if necessary

M = round(Smax/dS);

dS = Smax/M;

N = round(T/dt);

dt = T/N;

matval = zeros(M+1,N+1);

vetS = linspace(0,Smax,M+1)';

vetj = 0:N;

veti = 0:M;

% set up boundary conditions

matval(:,N+1) = max(X-vetS,0);

matval(1,:) = X*exp(-r*dt*(N-vetj));

matval(M+1,:) = 0;

% set up coefficients

a = 0.5*dt*(sigma^2*veti - r).*veti;

b = 1- dt*(sigma^2*veti.^2 + r);

c = 0.5*dt*(sigma^2*veti + r).*veti;

% solve backward in time

for j=N:-1:1

for i=2:M

matval(i,j) = a(i)*matval(i-1,j+1) + b(i)*matval(i,j+1)+ ...

c(i)*matval(i+1,j+1);

end

end

% find closest point to S0 on the grid and return price

% possibly with a linear interpolation

idown = floor(S0/dS);

iup = ceil(S0/dS);

if idown == iup

price = matval(idown+1,1);

else

price = matval(idown+1,1) + ...

(S0 –(idown+1)*dS)*(matval(iup+1,1) - matval(iup,1))/dS;

end

HW14

function [price,callprice,vetS,vetT] = EuCallImpl(S0,X,r,T,sigma,Smax,dS,dt)

M=round(Smax/dS);

dS=Smax/M;

N=round(T/dt);

dt=T/N;

callprice=zeros(M+1,N+1);

vetS=linspace(0,Smax,M+1)';

vetj=0:N;

veti=0:M;

vetT=linspace(0,T,N+1)';

callprice(:,N+1)=max(vetS-X,0);

callprice(1,:)=0;

callprice(M+1,:)=Smax-X*exp(-r*dt*(N-vetj));

a=0.5*(r*dt*veti-sigma^2*dt*(veti.^2));

b=1+sigma^2*dt*(veti.^2)+r*dt;

c=-0.5*(r*dt*veti+sigma^2*dt*(veti.^2));

coeff=diag(a(3:M),-1)+diag(b(2:M))+diag(c(2:M-1),1);

[L,U]=lu(coeff);

aux=zeros(M-1,1);

for j=N:-1:1

aux(M-1)=-c(M)*callprice(M+1,j);

%matval(2:M,j)=U\(L\(matval(2:M,j+1)+aux));

callprice(2:M,j)=coeff\(callprice(2:M,j+1)+aux);

end

idown=floor(S0/dS);

iup=ceil(S0/dS);

if idown==iup

price=callprice(idown+1,1);

else

price=callprice(idown+1,1)+(S0-idown*dS)*(callprice(idown+2,1)-callprice(idown+1,1))/dS;

end

function [C,callprice,vetS,vetT]=EurCallExp(S0,X,r,T,sigma,Smax,dS,dt)

M=round(Smax/dS);

dS=Smax/M;

N=round(T/dt);

dt=T/N;

callprice=zeros(M+1,N+1);

vetS=linspace(0,Smax,M+1)';

vetj=0:N;

veti=0:M;

vetT=linspace(0,T,N+1)';

callprice(:,N+1)=max(vetS-X,0);

callprice(1,:)=0;

callprice(M+1,:)=Smax-X*exp(-r*dt*(N-vetj));

a=0.5*dt*(sigma^2*veti-r).*veti;

b=1-dt*(sigma^2*veti.^2+r);

c=0.5*dt*(sigma^2*veti+r).*veti;

for j=N:-1:1

for i=2:M

callprice(i,j)=a(i)*callprice(i-1,j+1)+b(i)*callprice(i,j+1)+c(i)*callprice(i+1,j+1);

end

end

idown=floor(S0/dS);

iup=ceil(S0/dS);

if isequal(idown,iup)

C=callprice(idown+1,1);

else

C=callprice(idown+1,1)+(S0-(idown+1)*dS)*(callprice(iup+1,1)-callprice(iup,1))/dS;

end

S0=50;

X=50;

r=0.1;

T=5/12;

sigma=0.4;

Smax=100;

dS1=0.5;

dS2=1;

dS3=2;

dT=5/2400;

c=blsprice(S0,X,r,T,sigma);

ImpcalldS1=EuCallImpl(S0,X,r,T,sigma,Smax,dS1,dT);

ImpcalldS2=EuCallImpl(S0,X,r,T,sigma,Smax,dS2,dT);

ImpcalldS3=EuCallImpl(S0,X,r,T,sigma,Smax,dS3,dT);

c

ImpcalldS1

ImpcalldS2

ImpcalldS3

[price,callprice,vetS,vetT]=EuCallImpl(S0,X,r,T,sigma,Smax,dS1,dT);

%callprice

mesh(vetT,vetS,callprice);

ylabel('Stock price'); xlabel('Time'); title('European Call Option, Implicit Method');

S0=50;

X=50;

r=0.1;

T=5/12;

sigma=0.3;

Smax=100;

dS=2;

dT=5/1200;

[C,callprice,vetS,vetT]=EurCallExp(S0,X,r,T,sigma,Smax,dS,dT);

%callprice

C

mesh(vetT,vetS,callprice);

ylabel('Stock price'); xlabel('Time'); title('European Call Option, Explicit Method');

S0=50;

X=50;

r=0.1;

T=5/12;

sigma=0.3;

Smax=100;

dS=2;

dT=5/1200;

[C,callprice,vetS,vetT]=EurCallExp(S0,X,r,T,sigma,Smax,dS,dT);

%callprice

C

mesh(vetT,vetS,callprice);

ylabel('Stock price'); xlabel('Time'); title('European Call Option, Explicit Method');

x=50;

r=0.05;

t=0.5:0.5:10;

sig=0.2;

div=0;

s=60;

call_delta1= blsdelta(s,x,r,t,sig,div);

call_delta2= blsdelta(s-10,x,r,t,sig,div);

call_delta3= blsdelta(s-20,x,r,t,sig,div);

plot(t,call_delta1,'-')

hold on;

plot(t,call_delta2,'-r')

plot(t,call_delta3,'-g')

title('Delta vs. T')

xlabel('T')

ylabel('Delta')

legend('in the money','at the money','out of the money')

axis([0 10 0 1.2]);

Gamma

x=50;

r=0.05;

t=0.5:0.5:10;

sig=0.2;

div=0;

s=60;

call_delta1= blsdelta(s,x,r,t,sig,div);

call_delta2= blsdelta(s-10,x,r,t,sig,div);

call_delta3= blsdelta(s-20,x,r,t,sig,div);

plot(t,call_delta1,'-')

hold on;

plot(t,call_delta2,'-r')

plot(t,call_delta3,'-g')

title('Delta vs. T')

xlabel('T')

ylabel('Delta')

legend('in the money','at the money','out of the money')

axis([0 10 0 1.2]);

Gamma

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_gamma = blsgamma(s,x,r,t,sig,div);

plot(s,call_gamma,'-')

title('Gamma vs. s')

xlabel('s')

ylabel('Gamma')

legend('Gamma')

Theta

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_gamma = blsgamma(s,x,r,t,sig,div);

plot(s,call_gamma,'-')

title('Gamma vs. s')

xlabel('s')

ylabel('Gamma')

legend('Gamma')

Theta

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

[call_theta,put_theta]=blstheta(s,x,r,t,sig,div);

plot(s,call_theta,'-')

title('Theta vs. s')

xlabel('s')

ylabel('Theta')

legend('Theta')

Vega

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

[call_theta,put_theta]=blstheta(s,x,r,t,sig,div);

plot(s,call_theta,'-')

title('Theta vs. s')

xlabel('s')

ylabel('Theta')

legend('Theta')

Vega

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_vega = blsvega(s,x,r,t,sig,div);

plot(s,call_vega,'-')

title('Vega vs. s')

xlabel('s')

ylabel('Vega')

legend('Vega')

x=50;

r=0.05;

t=0.5;

sig=0.2;

div=0;

s=30:120;

call_vega = blsvega(s,x,r,t,sig,div);

plot(s,call_vega,'-')

title('Vega vs. s')

xlabel('s')

ylabel('Vega')

legend('Vega')

S0=50;

X=50;

r=0.1;

T=5/12;

sigma=0.3;

Smax=100;

dS=2;

dT=5/1200;

[C,callprice,vetS,vetT]=EurCallExp(S0,X,r,T,sigma,Smax,dS,dT);

%callprice

C

mesh(vetT,vetS,callprice);

ylabel('Stock price'); xlabel('Time'); title('European Call Option, Explicit Method');

S0=50;

X=50;

r=0.1;

T=5/12;

sigma=0.3;

Smax=100;

dS=2;

dT=5/1200;

[C,callprice,vetS,vetT]=EurCallExp(S0,X,r,T,sigma,Smax,dS,dT);

%callprice

C

mesh(vetT,vetS,callprice);

ylabel('Stock price'); xlabel('Time'); title('European Call Option, Explicit Method');